Brookdale Announces Third Quarter 2021 Results

November 4, 2021

Brookdale Senior Living Inc. (NYSE: BKD) (“Brookdale” or the “Company”) announced results for the quarter ended September 30, 2021.

HIGHLIGHTS

- Third quarter weighted average occupancy grew 200 basis points sequentially.

- Liquidity increased $258 million to $646 million at September 30, 2021, which reflects the impact of the successful completion of the sale of 80% of the Company’s equity in its Health Care Services segment.

- On October 1, 2021, the Company issued $230 million principal amount of 2.00% convertible senior notes due 2026.

“We are winning the recovery, with eight consecutive months of occupancy growth through October,” said Lucinda (“Cindy”) Baier, Brookdale’s President and CEO. “Throughout the pandemic, we’ve made great progress from a business and liquidity perspective. Our scale allows us to help protect and prioritize our residents and associates, like with our recent and rapid hosting of vaccine booster clinics in the vast majority of our communities. Additionally, this quarter we successfully closed a convertible notes offering that demonstrates the interest in Brookdale’s current and long-term growth opportunities.”

SUMMARY OF THIRD QUARTER RESULTS

Consolidated

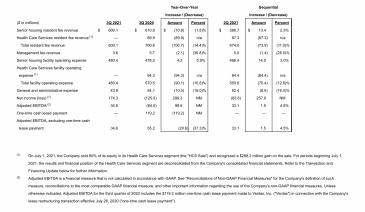

The table below presents a summary of consolidated operating results.

- Senior housing resident fee revenue.

- The Company estimates that the COVID-19 pandemic resulted in $76.4 million, $81.8 million, and $76.5 million of lost resident fee revenue in the consolidated senior housing portfolio for the third quarter of 2021, second quarter of 2021, and third quarter of 2020, respectively. The estimated lost resident fee revenue represents the difference between the actual resident fee revenue for the period and the Company’s pre-pandemic expectations for the 2020 period.

- 3Q 2021 vs 3Q 2020:

- Consolidated RevPAR decreased $22, or 0.6%, to $3,784 as a result of a decrease in consolidated weighted average occupancy of 280 basis points to 72.5%, offset by an increase in consolidated RevPOR of $163, or 3.2%, to $5,219. The increase in RevPOR was primarily the result of in-place rent increases and an occupancy mix shift to more memory care and skilled nursing services.

- The disposition of 12 communities through sales and conveyances of owned communities and lease terminations since the beginning of the third quarter of 2020 resulted in $7.4 million less in resident fees during the third quarter of 2021 compared to the third quarter of 2020.

- 3Q 2021 vs 2Q 2021: Consolidated RevPAR increased $92, or 2.5%, to $3,784 as a result of an increase in consolidated weighted average occupancy of 200 basis points to 72.5%, partially offset by a decrease in consolidated RevPOR of $18, or 0.3%, to $5,219.

- Management fee revenue.

- The decrease was primarily due to the transition of management arrangements on certain former unconsolidated ventures in which the Company sold its interest and interim management agreements on formerly leased communities.

- The decrease was primarily due to the transition of management arrangements on certain former unconsolidated ventures in which the Company sold its interest and interim management agreements on formerly leased communities.

- Senior housing facility operating expense.

- 3Q 2021 vs 3Q 2020:

- Senior housing facility operating expense increased $4.2 million, or 0.9%, primarily due to an increase in labor expense arising from increased contract labor and overtime costs due to the intensely competitive labor market, partially offset by a decrease in incremental costs to respond to the COVID-19 pandemic.

- The disposition of communities resulted in $7.7 million less in facility operating expenses during the third quarter of 2021 compared to the third quarter of 2020.

- 3Q 2021 vs 3Q 2020:

- 3Q 2021 vs 2Q 2021: Senior housing facility operating expense increased $14.0 million, or 3.0%, primarily due to an increase in labor expense arising from increased contract labor and overtime costs due to the intensely competitive labor market and an additional day of expense during the third quarter. Additionally, there was a seasonal increase in utility costs.

- The Company incurred $7.2 million, $8.9 million, and $22.1 million of incremental direct costs in the consolidated senior housing portfolio during the third quarter of 2021, second quarter of 2021, and third quarter of 2020, respectively, to respond to the COVID-19 pandemic, including costs for: acquisition of personal protective equipment (“PPE”), medical equipment, and cleaning and disposable food service supplies; enhanced cleaning and environmental sanitation; increased employee-related costs, including labor, workers compensation, and health plan expense; increased expense for general liability claims; and COVID-19 testing of residents and associates where not otherwise covered by government payor or third-party insurance sources.

- General and administrative expense.

- 3Q 2021 vs 3Q 2020: The decrease in general and administrative expense was primarily attributable to decreases in transaction costs, compensation costs as a result of a reduction in the Company’s corporate headcount related to the HCS Sale, and non-cash stock-based compensation expense.

- 3Q 2021 vs 2Q 2021: The decrease in general and administrative expense was primarily attributable to a decrease in compensation costs as a result of a reduction in the Company’s corporate headcount related to the HCS Sale and a decrease in estimated incentive compensation costs.

- Net income (loss).

- 3Q 2021 vs 3Q 2020: The increase in net income (loss) was primarily attributable to gain on sale of assets of $288.2 million from the HCS Sale and decreases in facility operating lease expense, depreciation and amortization expense, non-cash asset impairment expense, and general and administrative expense, partially offset by the net impact of the revenue and facility operating expense factors previously discussed and a $10.7 million decrease in other operating income.

- 3Q 2021 vs 2Q 2021: The increase in net income (loss) was primarily attributable to gain on sale of assets of $288.2 million from the HCS Sale and the general and administrative factors previously discussed, partially offset by a decrease in equity in earnings of unconsolidated ventures.

- Adjusted EBITDA.

- 3Q 2021 vs 3Q 2020: The increase in Adjusted EBITDA was primarily attributable to the $119.2 million one-time cash lease payment made to Ventas in connection with the Company’s lease restructuring transaction effective July 26, 2020 and the decrease in general and administrative expense (excluding non-cash stock based compensation expense and transaction and organizational restructuring costs), partially offset by the net impact of the revenue, other operating income, and facility operating expense factors previously discussed.

- 3Q 2021 vs 2Q 2021: The increase in Adjusted EBITDA was primarily attributable to the decrease in general and administrative expense (excluding non-cash stock based compensation expense and transaction and organizational restructuring costs), partially offset by the deconsolidation of the operating results of the Health Care Services segment and decreases in management fee revenue and other operating income.

- COVID-19 Impact.

- Vaccine Update: As of October 31, 2021, the Company’s resident vaccine acceptance rate was 95%. The U.S. Centers for Disease Control and Prevention (“CDC”) has recently recommended that certain populations, including residents in long-term care settings, should receive a COVID-19 booster dose. The Company has completed booster vaccine clinics in the vast majority of its communities. The Company has adopted a policy requiring its associates to be vaccinated against COVID-19, subject to limited exceptions, which the Company is implementing in a phased approach beginning with its corporate associates and field and community leadership.

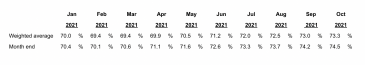

- Rebuilding Occupancy. The Company continues to execute on key initiatives to rebuild occupancy lost due to the pandemic. Beginning in March 2021, the Company has achieved eight consecutive months of weighted average consolidated senior housing occupancy growth on a sequential basis. According to data from the National Investment Center for the Seniors Housing & Care Industry (“NIC”), seniors housing occupancy increased 120 basis points from the second quarter to the third quarter of 2021 for stabilized portfolios. The Company’s weighted average consolidated senior housing occupancy increased 200 basis points sequentially for the third quarter of 2021 compared to the second quarter of 2021. During the third quarter of 2021, the nationwide spread of the Delta variant caused some moderation in the Company’s sequential monthly occupancy growth rate. The table below sets forth the Company’s consolidated occupancy trend during 2021.

-

- Community Restrictions. As of July 31, 2021, all of the Company’s communities were open for visitors, new resident move-ins, and prospective residents. During the third quarter of 2021, several of the Company’s communities experienced restrictions on visitors, new resident move-ins, and prospective residents, with a peak of such restrictions occurring in mid-September 2021. As of October 31, 2021, substantially all of the Company’s communities were open for visitors, new resident move-ins, and prospective residents. The Company may revert to more restrictive measures at its communities, including restrictions on visitors and move-ins, if the pandemic worsens, as necessary to comply with regulatory requirements, or at the direction of state or local health authorities.

- Financial Relief. In September 2021, the U.S. Department of Health and Human Services (“HHS”) announced that it has allocated $17.0 billion for a Phase 4 general distribution from the Provider Relief Fund. HHS will determine the exact amount of the payments after analyzing data from all the applications received. The Company applied for the Phase 4 general distribution and intends to pursue any additional funding that may become available. There can be no assurance that the Company will qualify for, or receive, such future grants in the amount it expects, that additional restrictions on the permissible uses or terms and conditions of the grants will not be imposed by HHS, or that future funding programs will be made available for which it qualifies.

Same Community Senior Housing (Independent Living (IL), Assisted Living and Memory Care (AL/MC), and CCRCs)

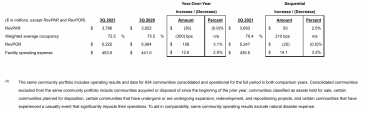

The table below presents a summary of same community operating results and metrics of the Company’s consolidated senior housing portfolio.(3)

- Resident fees.

- The Company estimates that the COVID-19 pandemic resulted in $74.4 million, $79.9 million, and $72.4 million of lost resident fee revenue for the Company’s same community senior housing portfolio for the third quarter of 2021, second quarter of 2021, and third quarter of 2020, respectively.

- 3Q 2021 vs 3Q 2020: Same community resident fees decreased $5.3 million to $569.6 million attributable to the decrease in occupancy, partially offset by the increase in RevPOR. The increase in RevPOR was primarily the result of in-place rent increases and an occupancy mix shift to more memory care and skilled nursing services.

- 3Q 2021 vs 2Q 2021: Same community resident fees increased $14.0 million to $569.6 million attributable to the increase in occupancy, partially offset by the decrease in RevPOR.

- Facility operating expense.

- 3Q 2021 vs 3Q 2020: The year-over-year increase was primarily due to an increase in labor expense arising from increased contract labor and overtime costs due to the intensely competitive labor market, partially offset by a decrease in incremental costs to respond to the COVID-19 pandemic.

- 3Q 2021 vs 2Q 2021: The increase was primarily due to an increase in labor expense arising from increased contract labor and overtime costs due to the intensely competitive labor market and an additional day of expense during the third quarter. Additionally, there was a seasonal increase in utility costs.

- The Company’s same community senior housing portfolio incurred $6.5 million, $8.3 million, and $20.5 million of incremental direct costs during the third quarter of 2021, second quarter of 2021, and third quarter of 2020, respectively, to respond to the COVID-19 pandemic.

LIQUIDITY

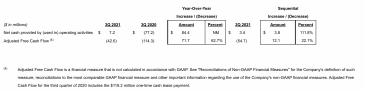

The table below presents a summary of the Company’s net cash provided by (used in) operating activities and Adjusted Free Cash Flow.

- Net cash provided by (used in) operating activities.

- 3Q 2021 vs 3Q 2020: The change in net cash provided by (used in) operating activities was primarily attributable to the $119.2 million one-time cash lease payment made to Ventas in connection with the Company’s lease restructuring transaction with Ventas effective July 26, 2020. This change was partially offset by $23.6 million of the employer portion of social security payroll taxes deferred during the prior year period and an increase in same community facility operating expenses compared to the prior year period.

- 3Q 2021 vs 2Q 2021: The increase in net cash provided by (used in) operating activities was primarily attributable to a decrease in recoupment of accelerated/advanced Medicare payments compared to the prior period as a result of the HCS Sale, and a decrease in distributions from unconsolidated ventures compared to the prior period.

- Adjusted Free Cash Flow.

- 3Q 2021 vs 3Q 2020: The $71.7 million change in Adjusted Free Cash Flow was primarily attributable to the change in net cash provided by operating activities, excluding an $8.4 million increase in lessor capital expenditure reimbursements, partially offset by a $5.3 million increase in non-development capital expenditures, net.

- 3Q 2021 vs 2Q 2021: The $12.1 million change in Adjusted Free Cash Flow was primarily attributable to a decrease in recoupment of accelerated/advanced Medicare payments compared to the prior period as a result of the HCS Sale, and a $7.6 million decrease in non-development capital expenditures, net, compared to the prior period.

- Total Liquidity. Total liquidity of $645.8 million as of September 30, 2021 included $478.5 million of unrestricted cash and cash equivalents, $157.9 million of marketable securities, and $9.4 million of availability on the Company’s secured credit facility. Total liquidity as of September 30, 2021 increased $258.0 million from June 30, 2021, primarily attributable to the HCS Sale on July 1, 2021, for net cash proceeds of $305.8 million at closing, partially offset by the negative $42.6 million of Adjusted Free Cash Flow during the third quarter of 2021.

TRANSACTION AND FINANCING UPDATE

- Sale of Health Care Services: On July 1, 2021, the Company completed the sale of 80% of its equity in its Health Care Services segment to affiliates of HCA Healthcare, Inc. (“HCA Healthcare”) for a purchase price of $400.0 million in cash, subject to certain adjustments set forth in the Securities Purchase Agreement (the “Purchase Agreement”) dated February 24, 2021, including a reduction for the remaining outstanding balance as of the closing of Medicare advance payments and deferred payroll tax payments related to the Health Care Services segment (the “HCS Sale”). The Company received net cash proceeds of $305.8 million at closing on July 1, 2021 and $6.8 million upon completion of the post-closing net working capital adjustment in October 2021. Pursuant to the Purchase Agreement, at closing of the transaction, the Company retained a 20% equity interest in the Health Care Services venture.

The results and financial position of the Company’s Health Care Services segment were deconsolidated from its consolidated financial statements as of July 1, 2021 and its 20% equity interest in the Health Care Services venture is accounted for under the equity method of accounting subsequent to that date. As of July 1, 2021, the Company recognized a $100.0 million asset within investment in unconsolidated ventures on its condensed consolidated balance sheet for the estimated fair value of its retained 20% noncontrolling interest in the Health Care Services venture. The Company recognized a $288.2 million gain on sale, net of transaction costs, for the HCS Sale for the three months ended September 30, 2021.

In September 2021, the Health Care Services venture entered into a Securities Purchase Agreement with LHC Group Inc., providing for the sale of home health, hospice, and outpatient therapy agencies in areas not served by HCA Healthcare. Upon the completion of the sale on November 1, 2021, the Company received $35.0 million of cash distributions from the HCS Venture from the net sale proceeds, which further enhanced its liquidity. The Company continues to retain a 20% equity interest in the remaining Health Care Services venture, which continues to operate home health, hospice, and outpatient therapy agencies in areas served by HCA Healthcare. - Convertible Debt Issuance: On October 1, 2021, the Company issued $230.0 million principal amount of 2.00% convertible senior notes due 2026. The Company received net proceeds of $224.3 million after the deduction of the initial purchasers’ discount. The Company used $15.9 million of the net proceeds to pay the Company’s cost of capped call transactions entered into in connection with the issuance, which are expected generally to reduce or offset potential dilution to holders of the Company’s common stock. Additionally, the Company used a portion of the net proceeds to repay a $45.0 million note payable and $29.2 million of mortgage debt and intends to use the remaining net proceeds for general corporate purposes, including refinancing or repaying maturing debt.

OUTLOOK

The Company expects Adjusted EBITDA for the fourth quarter of 2021 to be in the range of $35 million to $40 million.

This guidance excludes the potential impact of any government financial relief including distributions from the Provider Relief Fund or future acquisition or disposition activity other than the planned disposition of three communities classified as held for sale. Reconciliation of the non-GAAP financial measure included in the foregoing guidance to the most comparable GAAP financial measure is not available without unreasonable effort due to the inherent difficulty in forecasting the timing or amounts of items required to reconcile Adjusted EBITDA from the Company’s net income (loss). Variability in the timing or amounts of items required to reconcile the measure may have a significant impact on the Company’s future GAAP results.

SUPPLEMENTAL INFORMATION

The Company will post on its website at www.brookdaleinvestors.com supplemental information relating to the Company’s third quarter 2021 results, an updated investor presentation, and a copy of this earnings release. The supplemental information and a copy of this earnings release will also be furnished in a Form 8-K to be filed with the SEC.

EARNINGS CONFERENCE CALL

Brookdale’s management will conduct a conference call to review the financial results for the third quarter 2021 on November 5, 2021 at 9:00 AM ET. The conference call can be accessed by dialing (844) 200-6205 (from within the U.S.) or (929) 526-1599 (from outside of the U.S.) ten minutes prior to the scheduled start and referencing the access code “519846”.

A webcast of the conference call will be available to the public on a listen-only basis at www.brookdaleinvestors.com. Please allow extra time prior to the call to download the necessary software required to listen to the internet broadcast. A replay of the webcast will be available through the website following the call.

For those who cannot listen to the live call, a replay of the webcast will be available until 11:59 PM ET on November 12, 2021 by dialing (866) 813-9403 (from within the U.S.) or +44 (204) 525-0658 (from outside of the U.S.) and referencing access code “221605”.