Welltower Reports Third Quarter 2021 Results

November 4, 2021

Welltower Inc. (NYSE:WELL) today announced results for the quarter ended September 30, 2021.

Recent Highlights

- Reported net income attributable to common stockholders of $0.42 per diluted share

- Reported normalized FFO attributable to common stockholders of $0.80 per diluted share

- Seniors Housing Operating (“SHO”) portfolio occupancy increased approximately 210 basis points (“bps”) during the third quarter, exceeding our July guidance of an approximate gain of 190 bps

- Achieved same store REVPOR growth of 2.2% within the SHO portfolio during the third quarter, resulting in strong sequential same store revenue growth of 3.5%

- During the third quarter, year-over-year same store revenue growth for the SHO portfolio turned positive in the United States and United Kingdom for the first time since the beginning of the pandemic, a trend that accelerated into quarter end

- Completed $2.2 billion of pro rata gross investments during the third quarter and $4.1 billion year-to-date, including the previously announced acquisition of a portfolio of 85 seniors housing properties previously owned by Holiday Retirement for $1.58 billion

- Subsequent to quarter end, we entered into definitive agreements to acquire four distinct seniors housing portfolios for a pro rata gross investment amount of $1.3 billion

- Year-to-date, sold 29.5 million shares of common stock under our ATM program via forward sale agreements for total gross proceeds of approximately $2.4 billion, of which approximately 11.8 million shares remain unsettled which are expected to generate future gross proceeds of $1.0 billion

- Moody’s Investors Services and S&P Global Ratings revised their ratings outlook for Welltower to Stable from Negative and affirmed Welltower’s issuer credit ratings as ‘Baa1’ and ‘BBB+’, respectively

- Initiated a program with a national payor to deliver wellness coordination services through the presence of onsite Wellness Advisors to senior residents in the New York market. This partnership, the third such program across our seniors housing portfolio, will strengthen residents’ connection to health care and wellness resources, enabling aging in place and improved quality of life

- MSCI ESG rating upgraded to ‘AA’ from ‘A’, driven by our continued commitment to strong governance practices

COVID-19 Update

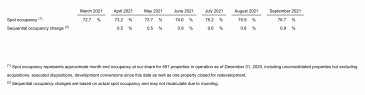

SHO Portfolio Virtually all of our communities are currently accepting new residents, resulting in an increase in move-in activity and occupancy rates. Month end occupancy rates are as follows:

In the current quarter, SHO portfolio expenses were significantly higher than expectations, driven by higher seasonal utility costs and elevated labor expenses mainly resulting from an increased utilization of contract labor due to a rise in occupancy and a challenging labor market. Our share of contract labor totaled $19 million, which resulted in an unfavorable sequential impact of $9 million or $0.02 per diluted share on net income attributable to common stockholders and normalized FFO for the three months ended September 30, 2021.

Our share of property-level expenses associated with the COVID-19 pandemic relating to our total SHO portfolio, net of reimbursements including Provider Relief Funds and similar programs in the U.K. and Canada, totaled a benefit of approximately $1 million and $25 million for the three and nine months ended September 30, 2021, respectively, as compared to an expense of approximately $17 million and $64 million for the three and nine months ended September 30, 2020, respectively. These costs included higher labor expenses coupled with expenditures related to procurement of personal protective equipment and other supplies, net of any reimbursements. Such amounts had a favorable impact on net income attributable to common stockholders and normalized FFO per diluted share of less than $0.01 and $0.06, for the three and nine months ended September 30, 2021, respectively, and an unfavorable impact of $0.04 and $0.15 per diluted share for the three and nine months ended September 30, 2020, respectively.

Capital Activity and Liquidity Inclusive of available borrowings under our line of credit, cash and cash equivalents, and IRC Section 1031 deposits, at September 30, 2021, we have $4.0 billion of near-term available liquidity and no material senior unsecured note maturities until 2024. On July 30, 2021, we entered into an amended and restated equity distribution agreement, which among other amendments, increased the total amount of shares of common stock that may be offered and sold under the ATM program from $2.0 billion to $2.5 billion. During the third quarter, we sold 11.5 million shares of common stock under our ATM program via forward sale agreements at an initial weighted average price of $84.36 per share which are expected to generate gross proceeds of approximately $966 million. Since the beginning of the year, we sold 29.5 million shares of common stock under our ATM program via forward sale agreements which are expected to generate gross proceeds of approximately $2.4 billion. As of September 30, 2021, approximately 11.8 million shares remain unsettled, which are expected to generate future gross proceeds of $1.0 billion.

Dividend On November 4, 2021, the Board of Directors declared a cash dividend for the quarter ended September 30, 2021 of $0.61 per share. This dividend, which will be paid on November 23, 2021 to stockholders of record on November 16, 2021, will be our 202nd consecutive quarterly cash dividend. The declaration and payment of future quarterly dividends remains subject to review and approval by the Board of Directors.

Quarterly Investment and Disposition Activity In the third quarter, we completed $2.2 billion of pro rata gross investments including $2.1 billion in acquisitions and loan funding as well as $141 million in development funding. We converted three development projects for an aggregate pro rata amount of $66 million. Additionally, during the quarter we completed pro rata property dispositions and loan payoffs of $488 million.

Notable Investment Activity Completed During the Quarter

Holiday Retirement During the third quarter, we closed on the previously announced acquisition of a portfolio of 85 seniors housing properties owned by Holiday Retirement for $1.58 billion. The portfolio is valued at $152,000 per unit, representing a discount to estimated replacement cost in excess of 30%. Atria Senior Living (“Atria”) assumed operations of the portfolio following its acquisition of the Holiday management company. The transaction has significant growth upside through the post-COVID recovery in seniors housing fundamentals, implementation of Atria’s technologically advanced operating platform and capital investment in assets.

Additionally during the third quarter, we acquired eight seniors housing communities operated by Holiday Retirement, now Atria, for $115 million or $126,000 per unit, representing a significant discount to replacement cost.

Aspect Health Acquisition As previously announced, we formed a new 95/5 joint venture with Aspect Health and simultaneously acquired seven medical office buildings in infill markets across the New York City metropolitan area for a pro rata investment amount of $98 million. The class-A portfolio has a weighted average remaining lease term of 12 years. With the transaction, we will have a 10-year exclusivity agreement with Aspect Health which allows the joint venture to finance future development projects in the New York City metropolitan area.

StoryPoint Senior Living As previously announced, in August we completed the acquisition of six seniors housing communities located in Ohio and Tennessee for approximately $141 million. In September, we acquired an additional property located in Wisconsin for approximately $19 million. The seven communities will be operated by StoryPoint under a triple-net master lease.

Other Transactions Additionally during the third quarter, we acquired four seniors housing communities for $44 million which were added to the existing RIDEA relationship with Frontier Management and one health system property for $16 million which was added to the in place triple-net lease with ProMedica. We disposed of 21 properties previously leased to Genesis, 13 properties previously leased to ProMedica in addition to one long-term/post-acute property and two medical office buildings for proceeds of $488 million, resulting in a gain on sale of $120 million.

Outlook for Fourth Quarter 2021 The degree to which the COVID-19 pandemic continues to impact our operations and those of our operators and tenants, including the variability in the timing of recovery, is dependent on a variety of factors and remains highly uncertain. Accordingly, we are only introducing earnings guidance for the quarter ended December 31, 2021 and expect to report net income attributable to common stockholders in a range of $0.20 to $0.25 per diluted share and normalized FFO attributable to common stockholders in a range of $0.78 to $0.83 per diluted share. In preparing our guidance, we have made the following assumptions:

- Provider Relief Funds: Our fourth quarter guidance does not include the recognition of any Provider Relief Funds which may be received during the quarter.

- SHO Portfolio Occupancy: Midpoint of normalized FFO guidance assumes a sequential increase in average pro rata occupancy of 140 bps in the fourth quarter.

- General and Administrative Expenses: We anticipate full year general and administrative expenses to be approximately $129 million to $131 million and stock-based compensation expense to be approximately $19 million.

- Investments: Our fourth quarter 2021 earnings guidance includes only those acquisitions closed or announced to date. Furthermore, no transitions or restructures beyond those announced to date are included.

- Development: We anticipate funding approximately $221 million of development in 2021 relating to projects underway on September 30, 2021.

- Dispositions: We expect pro rata disposition proceeds of $1.6 billion at a blended yield of 7.1% in 2021. This includes approximately $1.2 billion in proceeds from dispositions and loan payoffs completed through September 30, 2021, $283 million of expected proceeds from properties classified as held-for-sale as of September 30, 2021 and $26 million in expected loan payoffs.

Our guidance does not include any additional investments, dispositions or capital transactions beyond those we have announced, nor any other expenses, impairments, unanticipated additions to the loan loss reserve or other additional normalizing items. Please see the Supplemental Reporting Measures section for further discussion and our definition of normalized FFO and Exhibit 3 for a reconciliation of the outlook for net income available to common stockholders to normalized FFO attributable to common stockholders. We will provide additional detail regarding our fourth quarter outlook and assumptions on the third quarter 2021 conference call.