Brookdale Announces Fourth Quarter and Full Year 2021 Results

February 15, 2022

Brookdale Senior Living Inc. (NYSE: BKD) (“Brookdale” or the “Company”) announced results for the quarter and full year ended December 31, 2021.

HIGHLIGHTS

- Fourth quarter revenue per available unit (RevPAR) increased approximately 4% compared to the prior year quarter, including an 80 basis point increase in occupancy.

- Fourth quarter consolidated weighted average occupancy grew 100 basis points sequentially.

- Liquidity of $537 million strengthened by two significant fourth quarter financing transactions.

“In 2021, we proved that we could drive a strong recovery while in the second year of the pandemic,” said Lucinda (“Cindy”) Baier, Brookdale’s President and CEO. “We delivered ten months of sequential weighted average occupancy growth and maintained rate growth and discipline. We executed several significant transactions during the year to strengthen our liquidity position. Our top priority continues to be the health and wellbeing of our residents and associates. In the fourth quarter, we rapidly completed one or more booster clinics for each of our communities, which can provide our residents incremental protection. For 2022, we will build on our strong foundation and are well positioned for accelerated growth.”

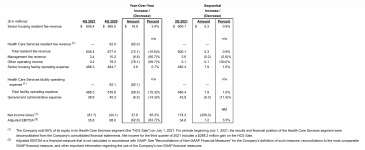

SUMMARY OF FOURTH QUARTER RESULTS

Consolidated

The table below presents a summary of consolidated operating results.

- Senior housing resident fee revenue.

- The Company estimates that the COVID-19 pandemic resulted in $75.6 million, $76.4 million, and $100.5 million of lost resident fee revenue in the consolidated senior housing portfolio for the fourth quarter of 2021, third quarter of 2021, and fourth quarter of 2020, respectively. The estimated lost resident fee revenue represents the difference between the actual resident fee revenue for the period and the Company’s pre-pandemic expectations for the 2020 period.

- 4Q 2021 vs 4Q 2020:

- Consolidated RevPAR increased $155, or 4.2%, to $3,828 as a result of an increase in consolidated RevPOR of $158, or 3.1%, to $5,210 and an increase in consolidated weighted average occupancy of 80 basis points to 73.5%. The fourth quarter of 2021 was the first quarter with year-over-year RevPAR growth since the first full quarter of the COVID-19 pandemic. The increase in RevPOR was primarily the result of in-place rent increases and an occupancy mix shift to more memory care and skilled nursing services.

- The disposition of six communities through sales of owned communities and lease terminations since the beginning of the fourth quarter of 2020 resulted in $5.1 million less in resident fees during the fourth quarter of 2021 compared to the fourth quarter of 2020.

- 4Q 2021 vs 3Q 2021: Consolidated RevPAR increased $44, or 1.2%, to $3,828 as a result of an increase in consolidated weighted average occupancy of 100 basis points to 73.5%, partially offset by a decrease in consolidated RevPOR of 0.2%, to $5,210.

- Management fee revenue.

- Management fee revenue for the fourth quarter of 2021 was lower sequentially and on a year over year basis primarily due to the transition of management arrangements on certain former unconsolidated ventures in which the Company sold its interest and interim management agreements on formerly leased communities.

- Other operating income.

- The Company recognized $0.2 million of government grants as other operating income during the fourth quarter of 2021, compared to $78.3 million of government grants during the fourth quarter of 2020 and $0.1 million of government grants during the third quarter of 2021.

- Senior housing facility operating expense.

- 4Q 2021 vs 4Q 2020:

- Senior housing facility operating expense increased $3.6 million, or 0.7%, primarily due to an increase in labor expense resulting from the increased use of contract labor and overtime to cover open positions, partially offset by a decrease in incremental direct labor costs to respond to the COVID-19 pandemic and decreases in employee benefits expense and workers compensation expense.

- The disposition of communities resulted in $5.5 million less in facility operating expenses during the fourth quarter of 2021 compared to the fourth quarter of 2020.

- 4Q 2021 vs 3Q 2021: Senior housing facility operating expense increased $7.9 million, or 1.6%, primarily due to an increase in labor expense resulting from the increased use of contract labor to cover open positions and partially offset by a decrease in employee benefits expense.

- During the fourth quarter of 2021, third quarter of 2021, and fourth quarter of 2020, in the consolidated senior housing portfolio the Company incurred $3.4 million, $7.2 million, and $28.1 million, respectively, of incremental direct costs to respond to the COVID-19 pandemic, including costs for: acquisition of personal protective equipment (“PPE”), medical equipment, and cleaning and disposable food service supplies; enhanced cleaning and environmental sanitation; increased employee-related costs, including labor, workers compensation, and health plan expense; and COVID-19 testing of residents and associates where not otherwise covered by government payor or third-party insurance sources.

- 4Q 2021 vs 4Q 2020:

- General and administrative expense.

- 4Q 2021 vs 4Q 2020: The decrease in general and administrative expense was primarily attributable to decreases in compensation costs primarily as a result of reductions in the Company’s corporate headcount related to the HCS Sale, estimated employee benefits expense, and transaction costs.

- 4Q 2021 vs 3Q 2021: The decrease in general and administrative expense was primarily attributable to decreases in estimated incentive compensation costs, estimated employee benefits expense, and transaction costs.

- Net income (loss).

- 4Q 2021 vs 4Q 2020: The increase in net loss was primarily attributable to the $78.1 million decrease in other operating income, partially offset by a $21.2 million increase in benefit for income taxes and the increase in senior housing resident fee revenue.

- 4Q 2021 vs 3Q 2021: The change in net income (loss) was primarily attributable to gain on sale of assets of $288.2 million recognized in the third quarter of 2021 for the HCS Sale, partially offset by a $38.7 million change in benefit (provision) for income taxes.

- Adjusted EBITDA.

- 4Q 2021 vs 4Q 2020: The decrease in Adjusted EBITDA was primarily attributable to the $78.1 million decrease in other operating income, partially offset by the increase in senior housing resident fee revenue.

- 4Q 2021 vs 3Q 2021: The increase in Adjusted EBITDA was primarily attributable to the increase in senior housing resident fee revenue and the decrease in general and administrative expense (excluding non-cash stock based compensation expense and transaction and organizational restructuring costs), partially offset by the increase in senior housing facility operating expense.

- COVID-19 impact.

- Vaccine Update: As of January 31, 2022, the Company’s resident vaccine acceptance rate was above 95%. By November 2021, the U.S. Centers for Disease Control and Prevention (“CDC”) recommended that all adults receive a vaccine booster dose. The Company has completed at least one booster vaccine clinic for all of its communities. In the second half of 2021, the Company adopted a policy requiring its associates to be vaccinated against COVID-19, subject to certain exceptions necessary to comply with applicable federal, state, and local laws.

- Rebuilding Occupancy. The Company continues to execute on key initiatives to rebuild occupancy lost due to the pandemic. In 2021, the Company achieved ten consecutive months of weighted average consolidated senior housing occupancy growth on a sequential basis. According to data from the National Investment Center for the Seniors Housing & Care Industry (“NIC”), senior housing occupancy increased 70 basis points from the third quarter to the fourth quarter of 2021 for stabilized portfolios. The Company’s weighted average consolidated senior housing occupancy increased 100 basis points sequentially for the fourth quarter of 2021 compared to the third quarter of 2021. The Company began to experience its typical seasonality pattern in January 2022. The table below sets forth the Company’s consolidated occupancy trend.

![]()

- Community Response. As of January 31, 2022, substantially all of the Company’s communities were open for new resident move-ins. The Company may revert to more restrictive measures at its communities, including restrictions on visitors and move-ins, if the pandemic worsens, as a result of infections at a community, as necessary to comply with regulatory requirements, or at the direction of authorities having jurisdiction.

- Financial Relief. In September 2021, the U.S. Department of Health and Human Services (“HHS”) announced that it has allocated $17.0 billion for a Phase 4 general distribution from the Provider Relief Fund. During the fourth quarter of 2021, the Company applied for the Phase 4 general distribution. The Company expects to receive the Phase 4 general distribution during the first half of 2022. The Company intends to pursue any additional funding that may become available. There can be no assurance that the Company will qualify for, or receive, such future grants in the amount it expects, that additional restrictions on the permissible uses or terms and conditions of the grants will not be imposed by HHS, or that future funding programs will be made available for which it qualifies.

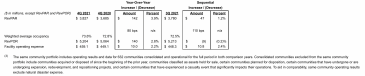

Same Community Senior Housing (Independent Living (IL), Assisted Living and Memory Care (AL/MC), and CCRCs)

The table below presents a summary of same community operating results and metrics of the Company’s consolidated senior housing portfolio.(3)

- Resident fees.

- The Company estimates that the COVID-19 pandemic resulted in $72.2 million, $73.7 million, and $94.9 million of lost resident fee revenue for the Company’s same community senior housing portfolio for the fourth quarter of 2021, third quarter of 2021, and fourth quarter of 2020, respectively.

- 4Q 2021 vs 4Q 2020: Same community resident fees increased $21.2 million to $570.2 million attributable to the increase in RevPOR and the increase in occupancy. The increase in RevPOR was primarily the result of in-place rent increases and an occupancy mix shift to more memory care and skilled nursing services.

- 4Q 2021 vs 3Q 2021: Same community resident fees increased $7.0 million to $570.2 million primarily attributable to the increase in occupancy.

- Facility operating expense.

- 4Q 2021 vs 4Q 2020: The year-over-year increase was primarily due to an increase in labor expense resulting from the increased use of contract labor and overtime to cover open positions, partially offset by a decrease in incremental direct labor costs to respond to the COVID-19 pandemic and decreases in employee benefits expense and workers compensation expense.

- 4Q 2021 vs 3Q 2021: The increase was primarily due to an increase in labor expense resulting from the increased use of contract labor and overtime to cover open positions, partially offset by a decrease in employee benefits expense.

- The Company’s same community senior housing portfolio incurred $3.2 million, $6.4 million, and $26.1 million of incremental direct costs during the fourth quarter of 2021, third quarter of 2021, and fourth quarter of 2020, respectively, to respond to the COVID-19 pandemic.

LIQUIDITY

The table below presents a summary of the Company’s net cash provided by (used in) operating activities and Adjusted Free Cash Flow.

- Net cash provided by (used in) operating activities.

- 4Q 2021 vs 4Q 2020: The change in net cash provided by (used in) operating activities was primarily attributable to $77.2 million of Provider Relief Funds and other government grants received during the prior year period, $22.5 million of the employer portion of social security payroll taxes deferred during the prior year period, and $31.6 million paid during the current year period for previously deferred payroll taxes. These changes were partially offset by an increase in same community resident fee revenue compared to the prior year period.

- 4Q 2021 vs 3Q 2021: The change in net cash provided by (used in) operating activities was primarily attributable to $31.6 million paid during the current period for previously deferred payroll taxes and increases in cash payments for employee compensation and real estate taxes compared to the prior period.

- Adjusted Free Cash Flow.

- 4Q 2021 vs 4Q 2020: The $158.6 million change in Adjusted Free Cash Flow was primarily attributable to the change in net cash provided by operating activities and an increase in non-development capital expenditures, net compared to the prior year period.

- 4Q 2021 vs 3Q 2021: The $96.1 million change in Adjusted Free Cash Flow was primarily attributable to the change in net cash provided by operating activities and an increase in non-development capital expenditures, net compared to the prior period.

- Total Liquidity. Total liquidity of $536.8 million as of December 31, 2021 included $347.0 million of unrestricted cash and cash equivalents, $182.4 million of marketable securities, and $7.4 million of availability on the Company’s secured credit facility. Total liquidity as of December 31, 2021 decreased $108.9 million from September 30, 2021, primarily attributable to negative $138.7 million of Adjusted Free Cash Flow and net cash used in financing activities, partially offset by $35.0 million of distributions from the Company’s unconsolidated Health Care Services venture.

TRANSACTION AND FINANCING UPDATE

- Convertible Debt Issuance: On October 1, 2021, the Company issued $230.0 million principal amount of 2.00% convertible senior notes due 2026. The Company received net proceeds of $224.3 million after the deduction of the initial purchasers’ discount. The Company used $15.9 million of the net proceeds to pay the Company’s cost of capped call transactions entered into in connection with the issuance, which are expected generally to reduce or offset potential dilution to holders of the Company’s common stock.

- Mortgage Financing: On December 17, 2021, the Company obtained $100.0 million of debt secured by the non-recourse first mortgages on 11 communities. The loan bears interest at a variable rate equal to the 30-day Secured Overnight Financing Rate (“SOFR”) plus a margin of 215 basis points and matures in January 2025, with the option to extend for two additional terms of one year each.

- Debt Repayment: During the fourth quarter of 2021, the Company repaid a $45.0 million high-interest-rate note payable and $284.4 million of mortgage debt, including $143.0 million of mortgage debt secured by the 11 communities for which $100.0 million of debt was obtained. Such repayments represented substantially all of the Company’s remaining 2022 maturities.

- Health Care Services Venture: On November 1, 2021, the Company’s unconsolidated Health Care Services venture sold certain home health, hospice, and outpatient therapy agencies in areas not served by affiliates of HCA Healthcare, Inc. to LHC Group Inc. Upon the completion of the sale, the Company received $35.0 million of cash distributions from the venture from the net sale proceeds. The Company continues to own a 20% equity interest in the remaining Health Care Services venture, which continues to operate home health, hospice, and outpatient therapy agencies in areas served by affiliates of HCA Healthcare, Inc.

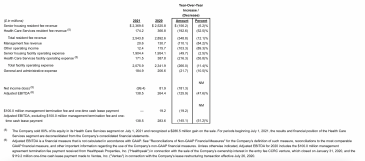

FULL YEAR RESULTS

Consolidated

The table below presents a summary of consolidated operating results.

OUTLOOK

For the full year 2022, the Company is providing the following guidance:

|

Full Year 2022 Guidance |

|

|

RevPAR growth |

10% – 12% |

|

Adjusted EBITDA |

$240 million – $260 million |

This guidance excludes the potential impact of any additional government financial relief including distributions from the Provider Relief Fund, and future acquisition or disposition activity other than the planned disposition of two communities classified as held for sale and the termination of the Company’s lease obligations on two communities for which it has provided notice of non-renewal. Reconciliation of the non-GAAP financial measure included in the foregoing guidance to the most comparable GAAP financial measure is not available without unreasonable effort due to the inherent difficulty in forecasting the timing or amounts of items required to reconcile Adjusted EBITDA from the Company’s net income (loss). Variability in the timing or amounts of items required to reconcile the measure may have a significant impact on the Company’s future GAAP results.

SUPPLEMENTAL INFORMATION

The Company will post on its website at www.brookdaleinvestors.com supplemental information relating to the Company’s fourth quarter and full year 2021 results, an updated investor presentation, and a copy of this earnings release. The supplemental information and a copy of this earnings release will also be furnished in a Form 8-K to be filed with the SEC.