Five Star Senior Living Inc. Announces Third Quarter 2021 Results

November 4, 2021

Five Star Senior Living Inc. (Nasdaq: FVE) today announced its financial results for the three months ended September 30, 2021.

Katherine Potter, President and Chief Executive Officer, made the following statement:

“For the third quarter of 2021, we reported a net loss of $10.2 million and an adjusted EBITDA loss of $3.3 million, which represented a $1.2 million improvement sequentially driven largely by occupancy improvement and cost containment measures. More specifically, as part of our strategic repositioning, we began rationalizing our work force and infrastructure during the third quarter.

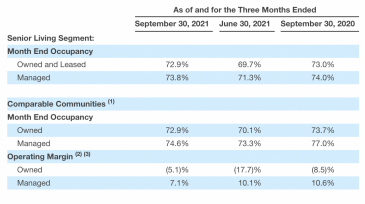

Occupancy in our portfolio of 20 owned communities increased 280 basis points at quarter end from the prior quarter. Likewise, occupancy in our 120 DHC retained managed communities, increased 130 basis points from the prior quarter. As of October 31, 2021, occupancy for these same 120 DHC retained managed communities has improved further to 74.9%, which represents a 250 basis point increase from pandemic lows.

We are encouraged by the continued occupancy growth within our owned and managed senior living portfolios as we drive efficiency and reposition our communities to fully participate in the upside of the senior living recovery. These positive occupancy trends have come as resident vaccination levels have increased throughout our senior living portfolio, while confirmed resident COVID-19 cases have declined to at or near pandemic lows. In addition, as of September 1, 2021, all community and clinic employees were in compliance with our requirement that they be fully vaccinated against COVID-19.

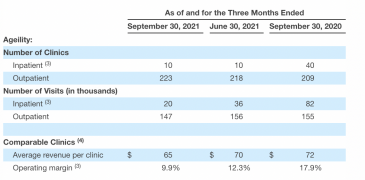

During the third quarter, we continued to transform our business to better address the changing needs and preferences of a growing older adult population, and to position Five Star for long term growth. We have made great progress on the repositioning phase of our strategic plan and, as of today, have transitioned 99 of the senior living communities with approximately 6,600 living units to new operators, closed 1,532 skilled nursing facility units and 27 of the planned Ageility inpatient clinics. We expect all community transitions to be completed by year end.

We have now shifted our focus to a sustained recovery by welcoming new residents and clients to our communities and clinics and embracing the return to our full resident, client and team member experience. With over $80 million of cash, $6.9 million of debt, and no outstanding balances on our revolving credit facility, our balance sheet remains flexible. We are well positioned to opportunistically diversify our revenue streams and pursue an expansion of our health and wellness services through new outpatient clinics and new service offerings.”

Third Quarter Summary of Financial Results:

Net loss for the third quarter of 2021 was $10.2 million, or $0.32 per share, which included $3.3 million loss from the termination of a lease and $1.2 million of expenses related to FVE’s restructuring, partially offset by $0.8 million to be reimbursed by Diversified Healthcare Trust, or DHC, related to the strategic plan announced by FVE on April 9, 2021, or the Strategic Plan, compared to net income of $3.7 million, or $0.12 per share, for the third quarter of 2020.

Earnings before interest, taxes, depreciation and amortization, or EBITDA, for the third quarter of 2021 was $(7.0) million compared to $7.1 million for the third quarter of 2020. Adjusted EBITDA, as described further below, was $(3.3) million for the third quarter of 2021 compared to $6.8 million for the third quarter of 2020. EBITDA and Adjusted EBITDA are non-GAAP financial measures. Reconciliations of net loss determined in accordance with GAAP to EBITDA and Adjusted EBITDA for the third quarter of 2021 and 2020 are presented later in this press release.

The following tables present data on the senior living communities that FVE owns, leases and manages as well as FVE’s Ageility rehabilitation clinics, and FVE’s comparable community data.