The Middle Market: A Conversation with United Church Homes’ Chief Growth Officer

By Jim Nelson | February 15, 2024

Middle Market. Two words that have come up in the senior living industry quite frequently in the five years since the survey funded by the National Investment Center (NIC) that led to its report The Forgotten Middle: Middle Market Seniors Housing Study.

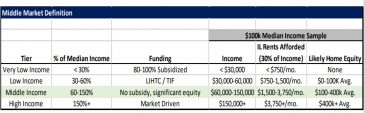

The “middle market,” as defined in NIC’s report, is those Americans with too much in financial resources to qualify for government support programs such as Medicaid, but not enough to pay most private pay options for very long.

The “middle market,” as defined in NIC’s report, is those Americans with too much in financial resources to qualify for government support programs such as Medicaid, but not enough to pay most private pay options for very long.

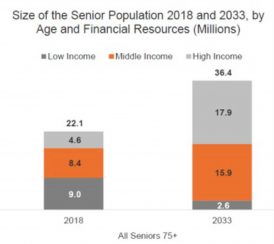

And as we know, the number of middle-income seniors is growing fast. The expectation is that there will be 6.4 million more of them by 2029, according to NIC’s report, a whopping 81 percent increase over 2014 numbers. Moreover, 75 percent of those middle-income seniors will not be able to afford assisted living unless they sell their homes, and nearly four in 10 of them (six million seniors) will not be able to afford assisted living even with home equity.

Terry Spitznagel is the Chief Growth Officer at United Church Homes, a company that is embracing the situation with aggressive expansion in the middle market. At this time, UCH has six communities in the middle market, and two in development.

Terry Spitznagel is the Chief Growth Officer at United Church Homes, a company that is embracing the situation with aggressive expansion in the middle market. At this time, UCH has six communities in the middle market, and two in development.

After spending the first part of her career in affordable housing, service coordination, senior living, senior services, Spitznagel was hired by UCH in February of 2020. How could she have known then that barely a month after accepting the job the pandemic would effectively spell the end of growth for a while? But give Spitznagel a chance and she’ll tell you about the positive aspect of her timing. It could have gone two ways, she told Senior Living News: It could have imploded, or it could have been the perfect opportunity to reimagine everything. “It really enabled us to take a look at our operations and say, ‘What do we do well, and more importantly, what do customers want?’”

SENIOR LIVING NEWS: How did you begin to define the middle market?

TERRY SPITZNAGEL: We know that 85 percent of adults will never live in any of our communities. Most people want to be at home. Affordable housing oftentimes is need-based, income-based, and if I make a little too much money, it’s not affordable. The other end of the spectrum is the CCRC or entry-fee model, and it’s out of reach. So where is, as NIC would say, this forgotten middle? “I make too much money to live here, and I really don’t have enough money to live there, so what am I going to do?”

If you put it into numbers there’s somewhere between 40 percent and 50 percent AMI [Area Median Income], up to 150 percent AMI. It’s a huge population base with a wide variety of income, so we broke it down. One, it has to be a private-pay model; the s no resources to help us develop it or fund the bricks-and-mortar or subsidize it. So, let’s look at a low-to-middle income, somewhere between the 30 percent to 60 percent AMI, something like that, and then the middle, middle income — probably more like 60 percent, 70 percent up to 110 percent AMI. The middle-to-high income can go up to 150 percent AMI. What could we do with all of that to even make more mixed income? You have somebody who’s in the 50 percent range and somebody who’s in the over-100 percent range — that was who we set out to target.

If you put it into numbers there’s somewhere between 40 percent and 50 percent AMI [Area Median Income], up to 150 percent AMI. It’s a huge population base with a wide variety of income, so we broke it down. One, it has to be a private-pay model; the s no resources to help us develop it or fund the bricks-and-mortar or subsidize it. So, let’s look at a low-to-middle income, somewhere between the 30 percent to 60 percent AMI, something like that, and then the middle, middle income — probably more like 60 percent, 70 percent up to 110 percent AMI. The middle-to-high income can go up to 150 percent AMI. What could we do with all of that to even make more mixed income? You have somebody who’s in the 50 percent range and somebody who’s in the over-100 percent range — that was who we set out to target.

When you look at a business model to do it, everything goes haywire with the amenities. So, when we’re asking, “What is it that folks really want?” what they wanted was customization. The baby boomers were saying, “I want to be able to pick and choose what I want, pay for what I want. Quit coming at me with, ‘Here’s everything and you have to buy it all.’”

The first two communities that we have were already in the United Church Homes portfolio; one was in the lower model and the other one was a middle model. The lower model was a senior rental community: it’s 55-and-over, you pay rent, and the rent is in that middle range. The middle one was three meals a day prepared by a cook, and you’ve got some other activities, and that’s also part of your rent, but services like Home Care Services or any other healthcare supportive wrap-around services would be coordinated by a service coordinator.

The non-negotiables for us were no entry fee, just like in any other apartment community that’s a rental, and the units were based on square footage so they would be competitive in the market, all 55-and-over. That’s first.

The second non-negotiable was service coordination — we call it NaviGuide — to make sure anybody who moved in at any one of our communities, somebody was helping them coordinate services as they age in place. So, it’s à la carte services and we’re going to help bring those to you, whether that’s a visiting physician program, personal care services, someone to help take care of the cat, transportation through Uber Health. As you start to age and experience bumps in the road, you have somebody to help navigate you through that.

The second non-negotiable was service coordination — we call it NaviGuide — to make sure anybody who moved in at any one of our communities, somebody was helping them coordinate services as they age in place. So, it’s à la carte services and we’re going to help bring those to you, whether that’s a visiting physician program, personal care services, someone to help take care of the cat, transportation through Uber Health. As you start to age and experience bumps in the road, you have somebody to help navigate you through that.

The variables in these models were the amenities. Additional amenities in the middle-to-high communities were things like meals, executive chef, light housekeeping twice a month. We added a life enrichment coordinator on staff doing five activities a day that each resident may wish to participate in. This has been a bit experimental — if I can use that word — and it is how we are evolving and learning more from the models we have in place today.

We have two communities that are doing well: a community that we built from the ground up and a community that was acquired by us, about 80 percent built when we acquired it. One’s a joint venture, one’s a full acquisition. They have not been from a playbook; there hasn’t been, “Here’s the model. This is how you do middle market.” We’ve led with what the customer wanted, we’ve led with the market study, we’ve led with what the geography is telling us. Most importantly, I think we’ve led with what the customer’s looking for, and they’re looking for à la carte.

SLN: What did you learn about the challenges that prevent more middle market communities for seniors?

TS: There wasn’t so much a challenge as it was maybe more like a strategic question: How are we designing these spaces? What’s going to be different now? What we’ve done in those cases where we have the opportunity to design the building as opposed to acquiring it, is we brought in people who were going to live in these spaces to inform the design. We brought in our operators to design it; we brought in architects and designers who have been studying and understanding what spaces need to look like to appeal to all these focus groups of baby boomers and trying to make sure we had all of that in these new designs. We had to throw out everything we knew about senior living before.

Six, seven years ago we would have just been designing our cookie-cutter approaches of senior living communities and sticking a sign on it and saying, “Here’s a middle market,” and we would have adjusted square footage and some of the finishing. We did not do that as we developed and designed these two new middle-market communities because we were very inspired by what the baby boomer population was saying they wanted. Some of it came out of COVID, too. So, the Hamlet on Darby project — that’s the one where we have the ranch-style individual unit — they’re duplexes, buildings that have quads in some of them, but residents said, “I want my car, I would like a garage. I want it to feel like it felt when I was at home, but I want it to feel like I’m a part of this community, I want to feel safe,” so we had to design them in a safe way, and then we flipped everything and said, “When you come up to your front door you can socially engage on your front porches with everyone in the community, because every building is looking in and everybody enters from the outside.” That was all about, “How do you keep six feet away? How do you feel socially engaged? How do you feel safe and sound?”

SLN: NIC found that nearly 40 percent of middle-income seniors, which adds up to about six million people, will not be able to afford to live in a community even if they have home equity. We keep hearing about how the boomers are coming, but the fact is, they’re here. The oldest boomers are now 77 and the youngest boomers are going to be 65 by 2029. How can these issues be solved in time?

SLN: NIC found that nearly 40 percent of middle-income seniors, which adds up to about six million people, will not be able to afford to live in a community even if they have home equity. We keep hearing about how the boomers are coming, but the fact is, they’re here. The oldest boomers are now 77 and the youngest boomers are going to be 65 by 2029. How can these issues be solved in time?

TS: I think about it a lot. One of the solutions we learned in affordable housing and in section 202 senior housing, HUD housing, is that they allow for service coordinators. In my experience, I’ve had hundreds of service coordinators working with older adults who have no resources. So, their challenge was, “How do we keep adults in low-income, affordable housing, people who make less than $12,000 a year, healthy, actively engaged, connected?” Service coordinators have taught us it is all about educating, connecting, linking to resources that are local in the community. Taking a lesson from that page, we said, “We need to put service coordinators into our middle markets, we need NaviGuides!” We did that also in skilled nursing and CCRCs — we’re putting them everywhere because everyone needs that. That was a non-negotiable, to make sure everyone has access to a service coordinator to figure out and understand and navigate all the resources that we could wrap around each older adult and their caregivers.

It’s the “just-in-time inventory” model. These services, when you need them, are just in time; you’re not paying for it before you need it, you’re paying for it exactly when you need it. So, we had our service coordinators follow that same sort of mentality. This makes it much more sustainable for a much longer period.

SLN: What can other senior living companies do to get more involved in the middle market?

TS: They could certainly call us or others that are doing it today. The senior living industry is pioneering this model, so we are learning from each other. I also think that being open to partnerships in the development of these communities has allowed us to learn and grow at a much faster pace. We’ve been in a place where we had to do it all. We had to be the developer, owner, the general contractor, we had to find all the financing, we had to find all the equity. In the instances where we have partnered, we found opportunities to do more with equity investors and also developers in other states.

The other thing we do as senior living providers is chase Medicare and Medicaid funding. We also all compete for the Low-Income Housing Tax Credit dollars … we chase that all over the place. So, when you can consider a business model and a capital stack that is all about private pay, it’s a little scary for folks in our industry. That just hasn’t been in our DNA. And I think that’s why it’s a little bit different, but there’s a lot of for-profit developers and a lot of not-for-profit developers that know how to do this or have tried it.